Effective February 12, 2024, hearings on Bill of Costs are no longer mandatory in the District of Colorado. Instead, costs disputes will be resolved primarily through the parties' electronic filing of supporting documentation in CM/ECF.

We encourage you to review the following materials which provide additional detail concerning our new process.

Governing Statutes & Rules

Components of Bill of Costs

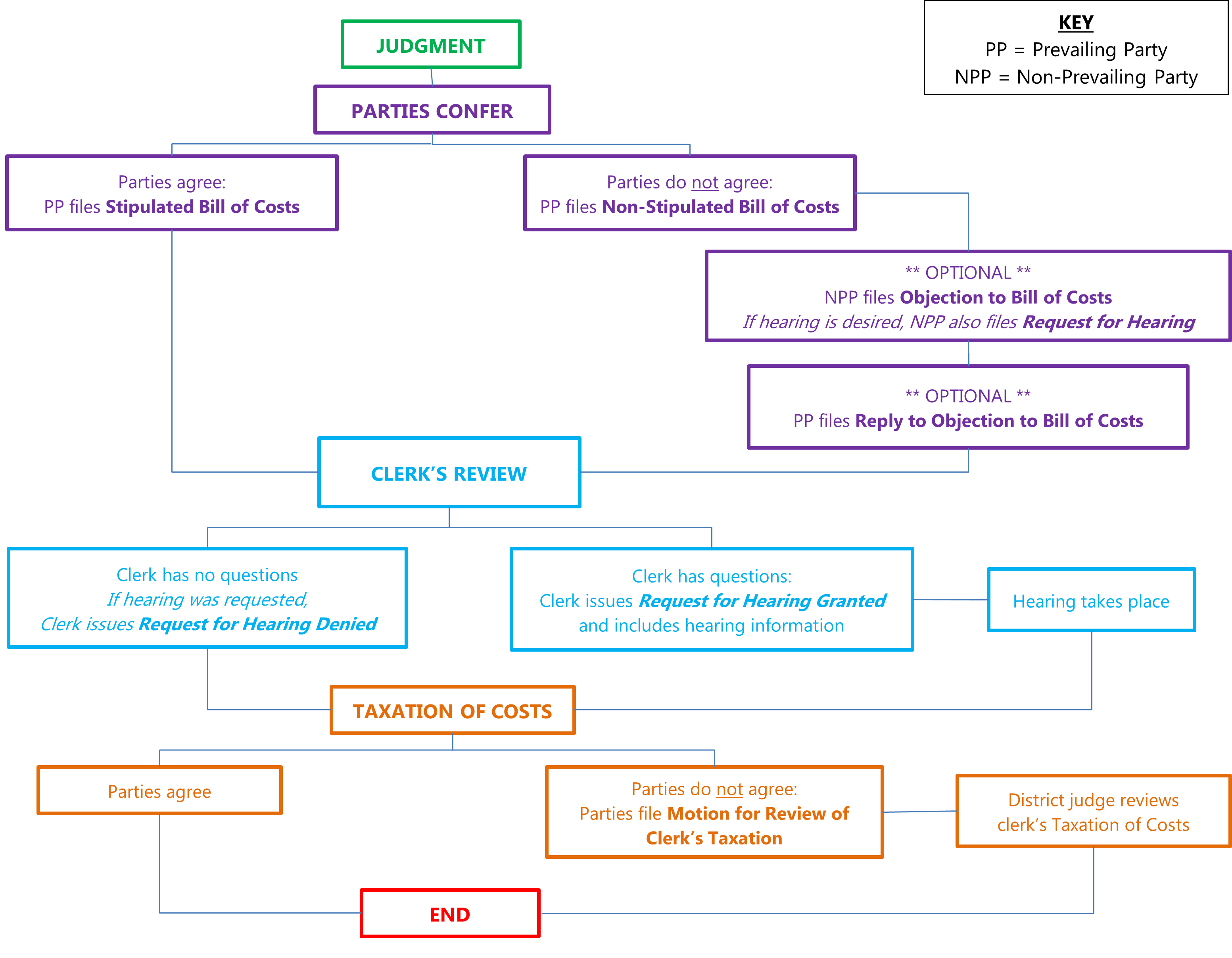

Diagram

Cheat Sheet for Costs

Frequently Asked Questions (FAQs)

Governing Statutes & Rules

|

Federal Rule of Civil Procedure 54(d)(1)

|

Costs Other Than Attorney's Fees. Unless a federal statute, these rules, or a court order provides otherwise, costs—other than attorney's fees—should be allowed to the prevailing party. But costs against the United States, its officers, and its agencies may be imposed only to the extent allowed by law. The clerk may tax costs on 14 days' notice. On motion served within the next 7 days, the court may review the clerk's action.

|

|

28 U.S. Code 1920

|

A judge or clerk of any court of the United States may tax as costs the following:

(1) Fees of the clerk and marshal;

(2) Fees for printed or electronically recorded transcripts necessarily obtained for use in the case;

(3) Fees and disbursements for printing and witnesses;

(4) Fees for exemplification and the costs of making copies of any materials where the copies are necessarily obtained for use in the case;

(5) Docket fees under section 1923 of this title;

(6) Compensation of court appointed experts, compensation of interpreters, and salaries, fees, expenses, and costs of special interpretation services under section 1828 of this title.

A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree.

|

|

D.C.COLO.LCivR 54.1

|

Each judgment or final order shall indicate any party entitled to costs. Unless otherwise ordered, the clerk shall tax costs in favor of a prevailing party or parties. A bill of costs shall be filed on the form provided by the court HERE no later than 14 days after entry of the judgment or final order. After filing a bill of costs and prior to appearing before the clerk, counsel and any unrepresented party seeking costs shall file a written statement that they have conferred as to disputes regarding costs. If all disputes are resolved, a stipulation specifying costs shall be filed with the court.

|

Components of Bill of Costs

Components of Bill of Costs

|

Guide to Taxation of Costs

Download Guide

|

A complete handbook and guide to Bill of Costs principles and procedures. This handbook is intended as a guide to any party seeking costs pursuant to D.C.COLO.LCivR 54.1. It does not express the viewpoints or policies of any judicial officer of the U.S. District Court. The final award of costs rests within the discretion of the presiding judicial officer.

|

|

Proposed Bill of Costs

Download Form & Instructions

|

Local Civil Rule D.C.COLO.LCivR 54.1.

|

|

Attachments

|

The filer must attach supporting documentation – invoices, copying charge lists, receipts, etc.

|

|

Summary Chart

|

Attach an itemized list, chart, or spreadsheet to keep track of requested categories and items.

|

|

Duty to Confer

|

A conferral between the parties to resolve any individual items or the costs as a whole must be documented by a written statement describing the conferral. If an agreement is reached to settle the bill of costs, the parties are directed to file a stipulation. If an agreement is not reached, the prevailing party must file its proposal and the non-prevailing party must respond with its objection. Should the prevailing party choose to withdraw its costs, a notice of this nature should be filed into the case, stating that taxation of costs is no longer sought.

|

|

Objections

|

The non-prevailing party may file an objection to the prevailing party’s proposed bill of costs within 14 days of the bill of costs’ filing. If the proposed bill of costs is disputed but an objection is not filed, the clerk will assess costs based on the information set forth in the proposal.

|

|

Hearings

|

As of February 1, 2024, bill of cost hearings are no longer mandatory. Should either party still desire to appear before the clerk, an appropriate request should be filed. If the clerk agrees that a hearing would be appropriate, the clerk will schedule one and notify the parties accordingly.

|

|

Taxation

|

The clerk will issue a taxation of costs based upon the parties’ filings and governing statutes. Should a hearing be necessary to clarify certain topics, either at the request of the parties or at the clerk’s discretion, taxation of costs will occur after the hearing takes place.

|

|

Disputing Clerk’s Taxation

|

The parties may dispute the clerk’s taxation of costs by filing an appropriate notice into the case. The district court judge assigned to the case will review the clerk’s taxation of costs and issue edits to it as needed. |

Diagram of Process

Cheat Sheet for Costs

|

Type of cost

|

Can it be awarded?

|

|

Filing fees

|

Yes, including fees paid in state court for removed cases.

|

|

Attorney’s bar admission fees

|

No. Admission fees are considered attorney expenses.

|

|

Service of process OR Subpoena fees

|

Yes, including fees paid to private process servers and the U.S. Marshal, as long as the costs are reasonable and justified.

|

|

Court hearing transcripts

|

Yes, if used for a substantive purpose and not simply for convenience.

|

|

Deposition transcripts

|

Yes, if used for a substantive purpose and not simply for discovery, and if reasonably necessary at the time obtained.

|

|

Deposition videos

|

Yes, if the need was reasonable and justified.

|

|

Witness fees

|

Yes, if the witness testified or was deposed and the associated deposition fees are awarded.

|

|

Expert witness fees

|

Yes, but the award amount will be the same as a non-expert witness.

|

|

Docket fees under § 1923

|

Yes

|

|

Court-appointed experts, interpreters, special masters fees

|

Yes

|

|

Private translators fees

|

No

|

|

Offer of Judgment fees

|

Yes, if the circumstances of the offer and outcome align with FRCivP 68.

|

|

Postage/mailing/courier fees

|

No

|

|

Copies

Pleadings & filings

Clients

Records from repositories

Initial disclosures

Discovery response

Depositions

Dispositive motion exhibits

Trial

Demonstrative exhibit

E-discovery (ESI)

|

No

No

Yes

No

Yes

Yes

Yes

Yes

Yes, if used and admitted.

Yes, but only to the equivalent of "copying."

|

Frequently Asked Questions (FAQs)

Is a separate affidavit necessary to accompany the bill of costs, pursuant to 28 U.S.C. § 1924?

No. The Bill of Costs form contains a declaration that adequately suffices as the affidavit required by § 1924.

Do I need to attach supporting documentation, such as invoices and receipts, to my bill of costs?

Yes.

Do I need to attach an itemized list, chart, or spreadsheet to assist the clerk in keeping track of requested categories and items?

Yes.

As the non-prevailing party, do I need to file an objection to the proposed bill of costs? If so, when?

No. There is no requirement to file an objection, but you may do so within 14 days of the bill of costs filing.

My client was sued by an inmate in a correctional or detention facility and we prevailed. Do I need to contact the inmate to confer about possible stipulation?

Yes. You must confer with the inmate by mail or through his/her case manager as to whether the inmate will agree to all or part of the costs. If the parties cannot reach an agreement, and either wishes to have a hearing to discuss further, also confer on the parties’ availability to attend a hearing so that it may be relayed to the clerk.

If the prevailing party won on only one claim, or otherwise received a partial award, are costs subject to reduction?

No.

Can costs be taxed against an indigent party?

Yes; however, the judge assigned to the case retains ultimate discretion.

Can costs be taxed under Colorado state law in diversity cases?

No. See Stender v. Archstone-Smith Operating Tr., No. 18-1432, 2020 WL 2109208 (10th Cir. May 4, 2020). Parties may file motions to the court for the application of state costs statutes in diversity cases; however, the clerk will only award costs pursuant to the Fed. R. Civ. P. 54(d)(1) and 28 U.S.C. § 1920 costs framework.

If costs are taxed against me, do I pay them through the court?

No. Payment of taxed costs is arranged directly between the parties and does not involve the court or the clerk.